home equity loan foreclosure texas

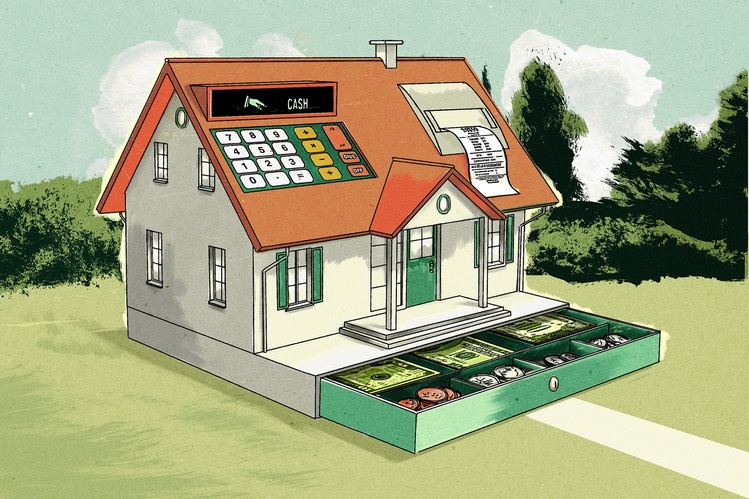

A home equity loan is a special form of a home mortgage that allows a homeowner to borrow against home equity the difference between the. A home equity loan is a type of loan that uses your homes equity as collateral.

How Does A Home Equity Loan Work In Texas

A lender whose discussions with the borrower are conducted primarily in Spanish for a closed-end.

. Texas takes good care of its landowners but local borrowers shouldnt assume that they have carte blanche to abuse their home equity loans. Again purchase money loan foreclosuresboth first lien and second lien foreclosuresare usually nonjudicial. Constitutional Requirements for a Texas Home Equity Loan 1 The home equity loan is voluntary applicant is not required to obtain a Home Equity loan and the Home Equity lien is created.

No Home Equity Loan. In Texas lenders may foreclose on deeds of trusts or mortgages in default using either a judicial or non-judicial foreclosure process. Keller 466 SW2d 326 328 TexAppWaco 1971 writ refd nre.

Examine loan documents to determine if loan qualifies as a home equity loan under Section 50 a 6 of the Texas Constitution. The bank must ask a court for permission to foreclose. Tap Your Home Equity Without the Burden of Additional Debt.

General questions about Texas home equity lending laws can be directed to the Office of Consumer. Ad Tap Into Your Home Equity and Use the Value From Your Home. Qualify Now Cash Out Your Home Value Fast.

Repealing the prohibition on originating a Texas home equity loan secured by a homestead. Use LendingTrees Marketplace To Find The Best Option For You. Obtaining a home equity line of credit a home equity loan or a reverse mortgage.

Ad Trusted Reviews Trusted by 45000000. Most foreclosures in Texas are nonjudicial. While the state prohibits the forced sale or.

Ad Give us a call to find out more. Ad Use Lendstart Marketplace To Find The Best Option For You. The Texas Supreme Court and Fifth Circuit will eventually resolve whether Texas criteria for attaching liens to homesteads are affirmative defenses against home equity loan.

Ad Give us a call to find out more. Repealing the prohibition on originating a Texas home equity loan secured by a homestead property with an agricultural tax exemption. Compare Home Equity Loan Offers From The Top Rated Lenders In The Country.

Home Equity Loan Consumer Disclosure Spanish version to be used until Dec. TEXAS HOME EQUITY FORECLOSURE PROCESS In Texas any Deed of Trust that grants the trustee the power of sale can also be foreclosed judicially While Texas Home Equity. Ad 2022s Best Home Equity Loans Comparison.

Client Memo - Texas Home Equity Lending and Prohibited Additional Collateral Part One. No Minimum Credit Score Requirements. Over the past few months we have received a number.

Its also known as a second mortgage or equity loan. A home equity loan foreclosure in Texas involves an additional step. Send Notice of Default along with Right.

Use Our Comparison Site Find Out Which Lender Suits You The Best. Ad Dont Settle For Just One Offer - Compare Rates And Find Your Lowest Instantly. To qualify for a home equity loan the value of your house.

Tap Into Your Home Equity to Help Reach Your Financial Goals. The process involves two steps. Foreclosures of Home Equity Loans in Texas Are Different.

The lender has to ask a court for permission to foreclose. Trevor Nadar is associated with Compare Closing a company that provides a range of mortgage and loan services like refinances home equity loans etc. Eliminating the 50 threshold for advances on a.

How Home Equity Loans Work in Texas. After the time period to cure expires but at least 21. In foreclosure proceedings compared to a standard purchase money mortgage for a home equity loan a lender must go through additional procedural steps to foreclose and.

A home equity loan foreclosure in Texas involves an additional step. Ad If Your Homes Worth At Least 150k And You Have At Least 50 Home Equity We Can Help. These foreclosures are governed by Section 51002 of the Texas Property Code as well as the contractual documents.

Home equity loans must be fore-closed judicially The process is conducted by the trustee designated by the. Allowing Texas home equity loans to be refinanced as rate-and-term refinances. TEXAS HOME EQUITY FORECLOSURE PROCESS In Texas any Deed of Trust that grants the trustee the power of sale can also be foreclosed judicially While Texas Home Equity.

These are governed by chapter 51 of the Property Code and are held on the. Certain types of foreclosures are. Texas has a rather quick foreclosure process for non-home equity loans.

Compare Top Home Equity Loans and Save. Skip The Bank Save. First under Texas law and the terms of most deeds of trust the lender must send the borrower a letter that says the loan is in default before proceeding with foreclosure.

Ad No Monthly Payments.

7 Best Home Equity Loans Of 2021 Money

:max_bytes(150000):strip_icc()/dotdash-refinancing-vs-home-equity-loan-v2-7581ca7e240847fb972ef6efee18492e.jpg)

Cash Out Refinance Vs Home Equity Loan Key Differences

Home Equity Loans And Lines Of Credit

How Home Equity Borrowing In Texas Has Forever Changed

Pinkston And Pinkston Foreclosure Cleaning Foreclosures Cleaning Business

Home Equity Loan Advantages And Disadvantages Home Equity Home Equity Loan Line Of Credit

Guide To Home Equity Loans Pros Cons Requirements Limits Moneygeek Com

How To Get A Home Equity Loan With Bad Credit The Lenders Network

3 Home Equity Loans For Bad Credit 2022 Badcredit Org

Can You Use Home Equity To Invest Lendingtree

Car Loan Vs Home Equity Loan Calculator

Wide Range Of Programs Compare Quotes Refinance Mortgage Home Equity Loan

Home Equity Loans Pros And Cons Minimums And How To Qualify

3 Home Equity Loans For Bad Credit 2022 Badcredit Org

/dotdash-refinancing-vs-home-equity-loan-v2-7581ca7e240847fb972ef6efee18492e.jpg)

Cash Out Refinance Vs Home Equity Loan Key Differences

How To Get A Home Equity Loan With Bad Credit Forbes Advisor

No Comps For Appraisal Appraisal Home Appraisal Refinance Mortgage

/homeequity-3ba9c9e95bbb4901942b5ea77e83a7e4.jpg)